Unlocking Africa’s local currency debt

Africa’s quiet revolution in fixed income

In a world where fixed-income investors are chasing yield and dodging rate shocks, one opportunity is hiding in plain sight: African local-currency sovereign bonds.

Africa isn’t one market—it’s 54 unique economies, currencies, and policy frameworks. But one thing is becoming increasingly clear: this is one of the most compelling risk-reward setups in global fixed income today.

The local debt market has quietly topped $800 billion, with better liquidity than many of the region’s equity markets. This is no longer just a sandbox for DFIs—it’s a space institutional capital can’t afford to ignore.

Reform-led yields, not crisis-led distress

Africa’s top local-currency bond markets are delivering double-digit returns—but this time the story isn’t about turmoil. It’s about turnaround.

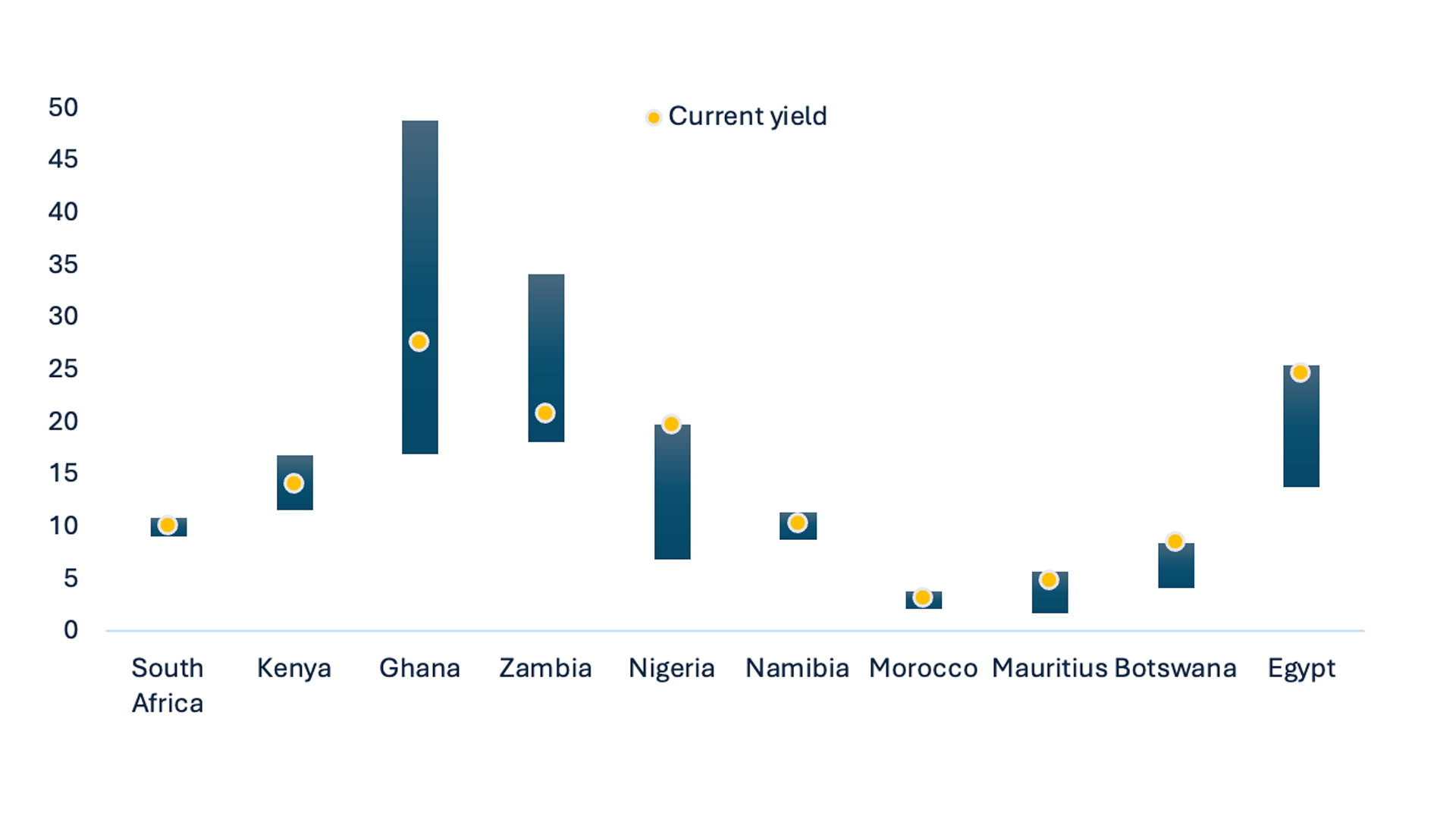

- Egypt, Ghana, Nigeria are yielding 15%–20%+ yields, backed by IMF programs, fiscal resets, and tighter monetary policy.

- Kenya, South Africa, Zambia sit in the 10%–18% range, underpinned by structural reforms and falling inflation.

- Namibia, Morocco, Botswana, and Mauritius offer 6%–10%, combining macro stability with strong institutional frameworks.

Africa’s real yields — among the highest globally — are becoming increasingly attractive as inflation trends downward across much of the continent. In Sub-Saharan Africa in particular, proactive monetary tightening has helped bring inflation under control.

More importantly, structural reforms are no longer theoretical. From Nigeria’s bold removal of fuel subsidies to the comprehensive debt restructurings underway in Zambia and Ghana, these reforms are shifting credit narratives and reducing long-term investment risk.

For investors hunting carry, reform, and genuine diversification, the time to lean in is now.

Graph 1: Current vs historical yield range by country from 2018 to 2025; blue bars represent yield range per country from 2018 to 2025, while yellow dot showing current yield, providing context on where today’s yield stands within the multi-year range.

Diversification that works

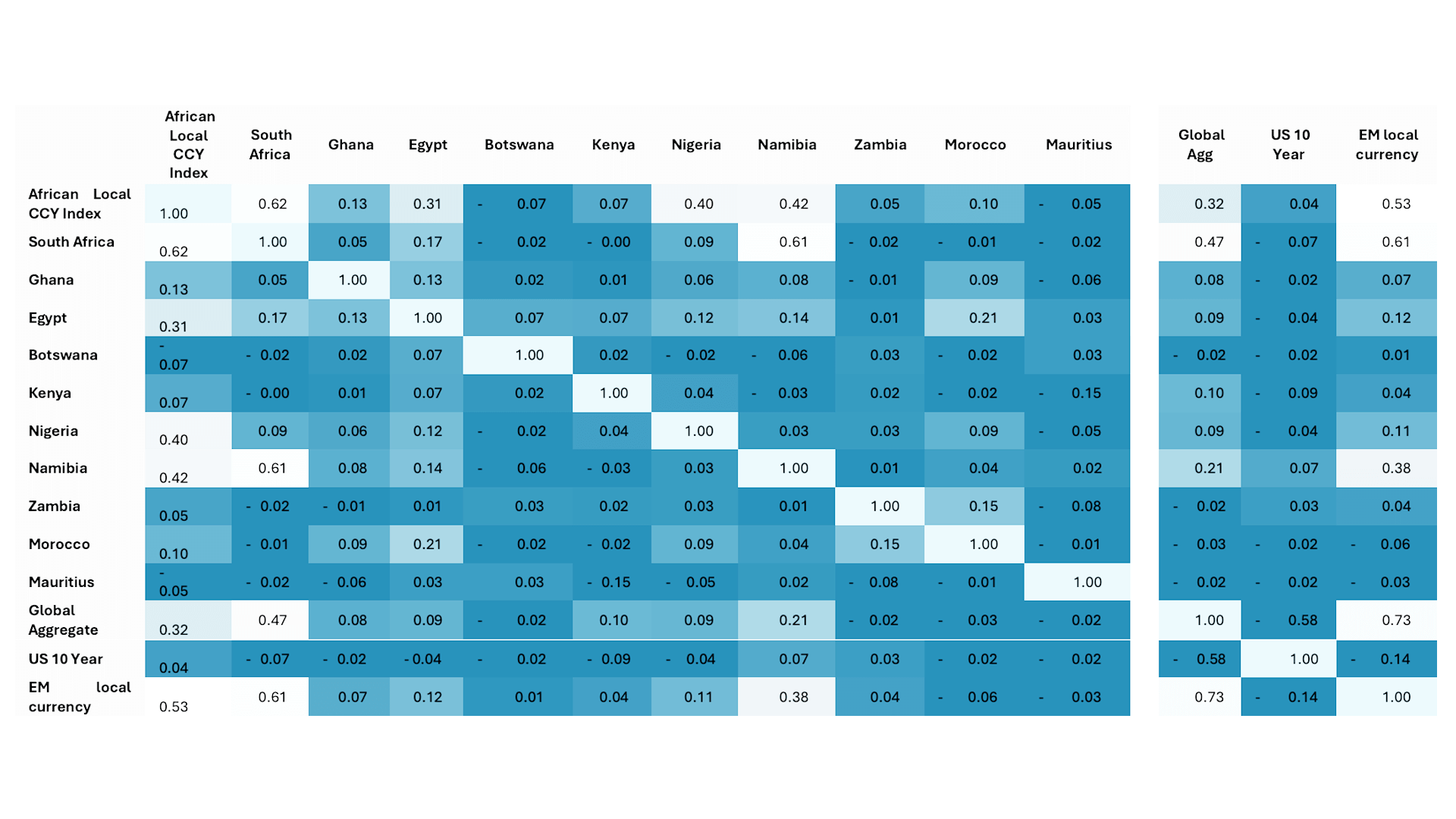

What makes African bonds stand out? They move differently from the rest of your portfolio.

- During the global bond rout of 2022–2024, African yields stayed largely stable.

- Local central banks focused on inflation, not the Fed.

- Cross-market correlations—whether with Treasuries, EM indices, or even across African markets—are near zero.

This is real diversification. You’re getting multiple return streams that behave differently—and that smooths out portfolio volatility over time.

Graph 2: Correlation Matrix of African Local-Currency Bonds vs. Global Benchmarks

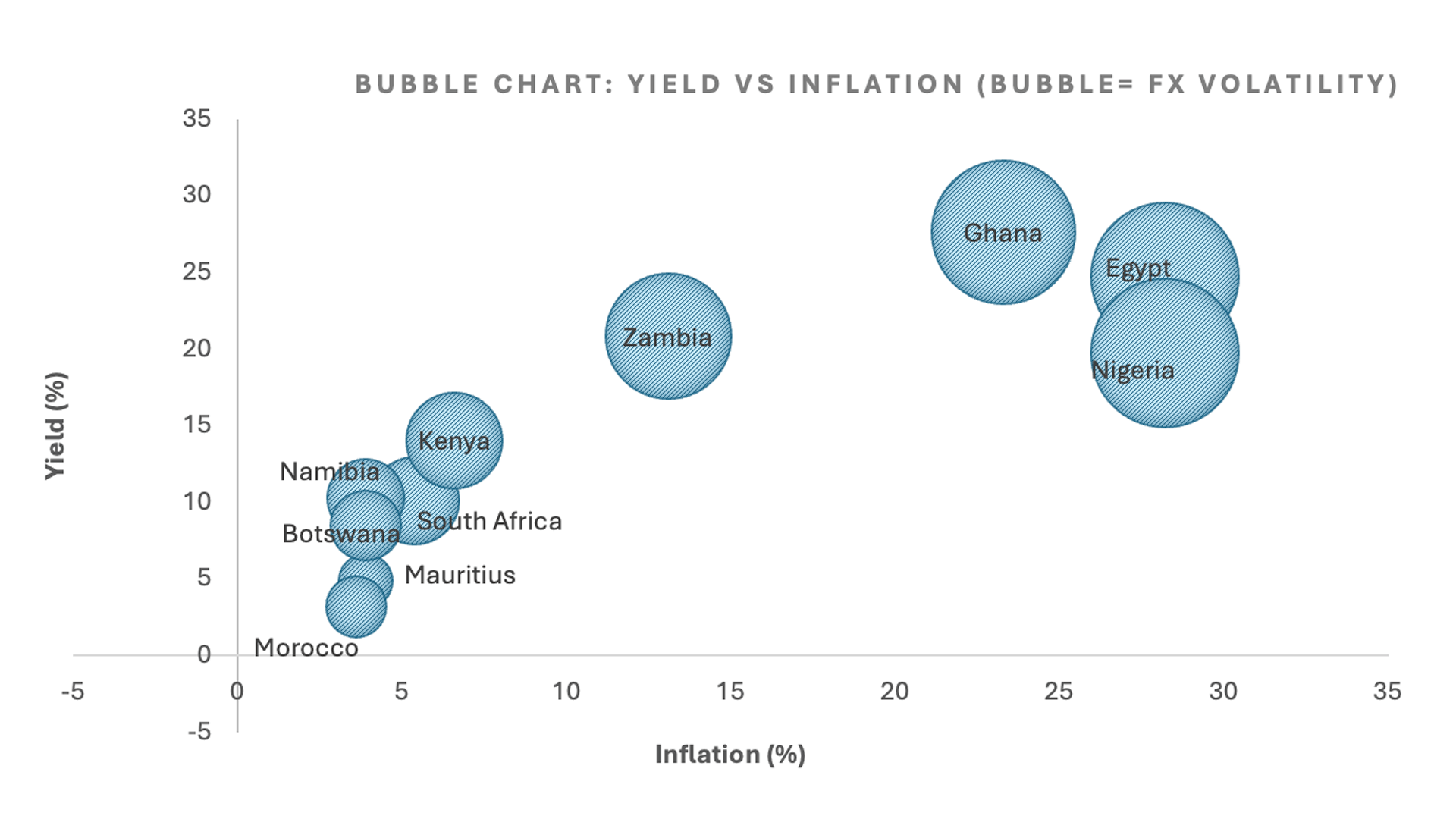

Currency risk or Currency alpha?

Currency volatility in Africa isn’t just a risk to hedge—it’s a source of return to harness. We believe, with the new US administration, the focus is going to be on a weaker dollar, or at least not the significant appreciating dollar we’ve seen over the last 15 years. As reforms kick in and external balances improve, currency returns, which have historically detracted from returns, can turn from headwind to tailwind. That’s why sophisticated investors are increasingly choosing to stay unhedged—not to take more risk, but to capture more return.

Graph 3: Bubble chart: Yield vs Inflation (Bubble= FX Volatility)

Each bubble represents a country’s local-currency sovereign bond profile. Larger bubbles indicate higher currency volatility. Ideal positioning: top-left quadrant = high yield, low inflation, manageable FX risk.

Access is easier. Markets are deeper.

Africa’s local markets aren’t just growing—they’re maturing.

- Longer tenors and deeper secondary curves are reshaping the yield landscape.

- Domestic pension and insurance assets now exceed $1.2 trillion, anchoring demand.

- Bid-ask spreads are narrowing. Price discovery is improving.

Global allocators can now access this opportunity in a way that’s liquid, diversified, and simple: via the African Domestic Bond Fund (ADBF)—the world’s first ETF focused exclusively on African local-currency government bonds.

Launched with the African Development Bank and powered by MCB Capital Markets, ADBF is the access point investors have been waiting for.

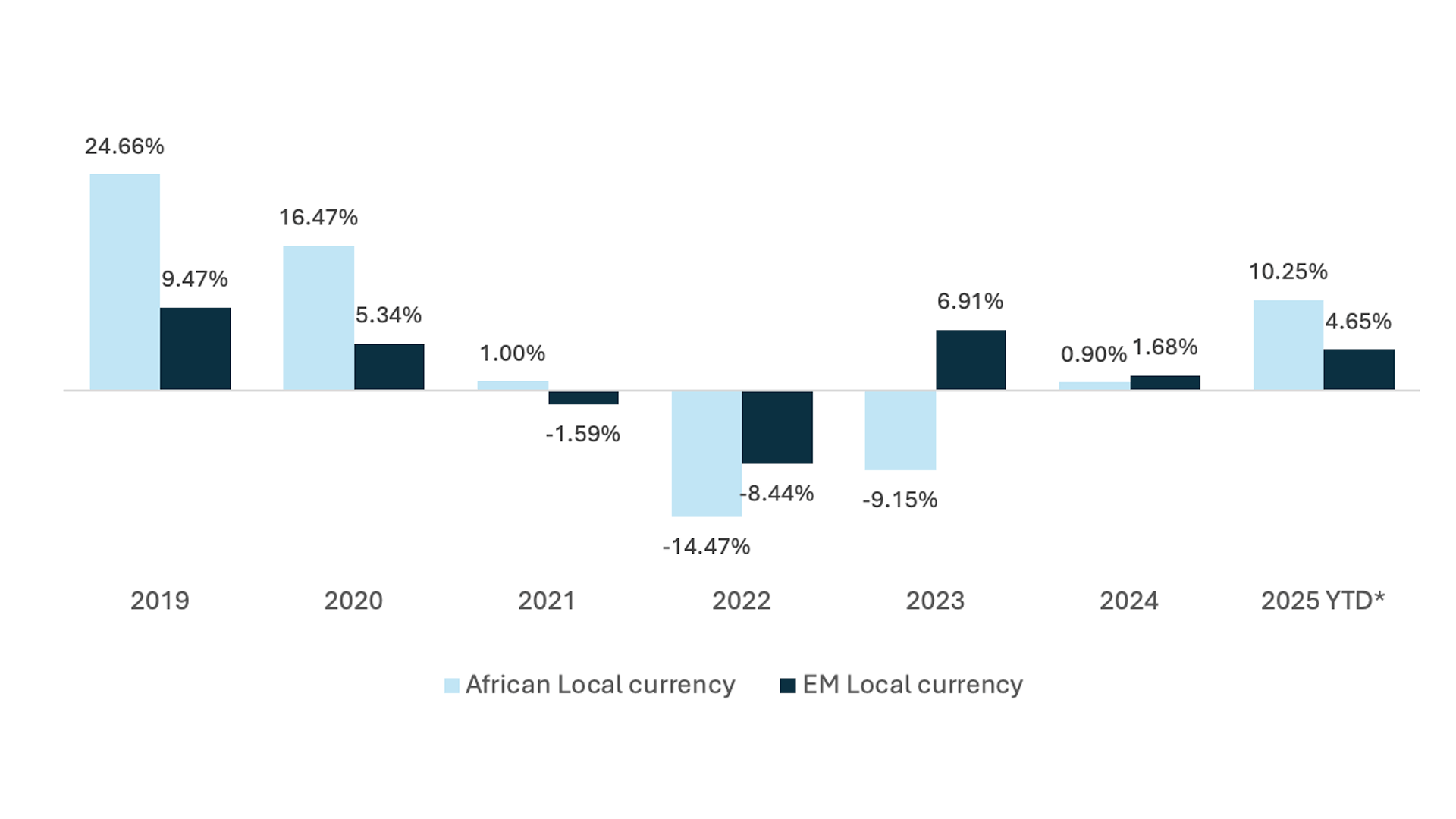

Graph 4- A comparative line chart showing ADBF returns vs. traditional EM local-currency bond indices.

*as at April 2025

The case is built. The access exists. The time is now.

For too long, African local debt was dismissed as exotic or inaccessible. But the numbers have changed. The access has changed. And the risk-reward has shifted.

Today, African local-currency bonds offer one of the few ways to get yield, diversification, and reform momentum in a single package.

For global fixed-income allocators looking beyond the usual suspects—this is the unlock.